Precision, Perfected.

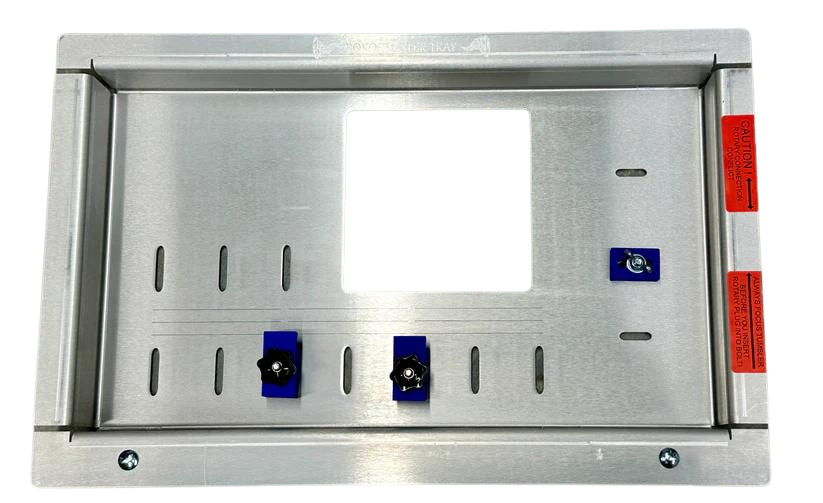

Bolt Accessories

Nothing but smooth gliding, speedy production times, and powerful cuts.

Nova Accessories

Aurora 8 UV Accessories

Confidently mark, engrave, and work your way through big batch orders.

Aurora Lite and Aurora 8 Accessories

Deliver clear, custom results with incredible accuracy and high resolution.

Accessories

Precision, perfected.

Your creations are unique, so your machines should be, too. Our enterprise-grade accessories allow you to customize your machine to fit your needs.

Meet your next Machine

Bolt, Nova, Odin, and Aurora. Four machine types with different models to match your creativity. Get the perfect machine to match your favorite accessories.

Finance Today and Expect

Unlike traditional lenders, Geneva Capital can customize terms, payment due dates, and more to fit your individual needs. A trustworthy Lender who works for you

Fast, convenient finance solutions for businesses of all sizes—including start-ups

Work with a direct lender, not a broker (they’ll never sell your agreement)

In-house credit decisions ensure each application is individually reviewed

Product knowledge—21+ years of experience in this industry

Financing options for challenged credit

Attractive pricing and fixed, flexible payments (and they’ll also help you with tax benefits)

Premium Products Without the Premium Cost

What’s pricey, unreliable, and outdated? Not our laser machines, that’s for sure.

At Thunder Laser, we support your creative ventures and financial goals, and our products reflect that. Instead of inflating costs and trying to oversell you on some fancy features you’ll probably never use, we want to make sure you’re getting exactly what you need from our machines.

Most makers only use 80% of the features in their laser engraving systems. With Thunder Laser, our experts talk to you, learn what you need, and help you select the best model for you—without any hidden fees or costs. Still convinced you need all the bells and whistles laser technology could possibly offer? Our Nova 63 will get you all that for far less than you’d expect.

Does this sound too good to be true? Reach out and we’ll prove it.

Benefits of Financing

There are a number of exciting reasons why financing could be the best option for you to get your own laser engraving system.

Special Structuring for Start-Ups

Tax-Deductible Lease Payments

Deferred Payment Options

100% Financing

$0 Down Options

Flexible Terms

Financing FAQ

If you’re considering starting a laser engraving or cutting business, or if you’re thinking about purchasing your own laser system, you might have questions about the best way to go about acquiring your equipment.

Are there tax advantages to financing?

Yes. In fact, one of the most appealing reasons new business owners lease equipment is because the Internal Revenue Service (IRS) does not consider an operating lease to be a purchase; rather it is a tax-deductible overhead expense. Therefore, you can deduct the lease payments from your corporate income.

What are typical finance terms?

Yes. In fact, one of the most appealing reasons new business owners lease equipment is because the Internal Revenue Service (IRS) does not consider an operating lease to be a purchase; rather it is a tax-deductible overhead expense. Therefore, you can deduct the lease payments from your corporate income.

Does financing require a significant down payment?

Yes. In fact, one of the most appealing reasons new business owners lease equipment is because the Internal Revenue Service (IRS) does not consider an operating lease to be a purchase; rather it is a tax-deductible overhead expense. Therefore, you can deduct the lease payments from your corporate income.

How does financing affect my cashflow?

Yes. In fact, one of the most appealing reasons new business owners lease equipment is because the Internal Revenue Service (IRS) does not consider an operating lease to be a purchase; rather it is a tax-deductible overhead expense. Therefore, you can deduct the lease payments from your corporate income.

Business is good – can I finance more equipment while still loaning my existing system?

Yes. In fact, one of the most appealing reasons new business owners lease equipment is because the Internal Revenue Service (IRS) does not consider an operating lease to be a purchase; rather it is a tax-deductible overhead expense. Therefore, you can deduct the lease payments from your corporate income.

How does financing look to potential lenders?

Yes. In fact, one of the most appealing reasons new business owners lease equipment is because the Internal Revenue Service (IRS) does not consider an operating lease to be a purchase; rather it is a tax-deductible overhead expense. Therefore, you can deduct the lease payments from your corporate income.